A Comprehensive Overview to How Credit Scores Repair Can Change Your Credit Report Score

Recognizing the complexities of credit rating fixing is vital for anybody looking for to improve their monetary standing - Credit Repair. By addressing concerns such as payment background and credit scores application, individuals can take aggressive actions toward boosting their credit rating. The procedure is often laden with misunderstandings and prospective pitfalls that can hinder development. This guide will certainly illuminate the crucial methods and considerations needed for effective credit scores repair, inevitably exposing how these initiatives can lead to a lot more favorable economic opportunities. What continues to be to be explored are the details activities that can set one on the path to an extra durable credit history profile.

Understanding Credit Report

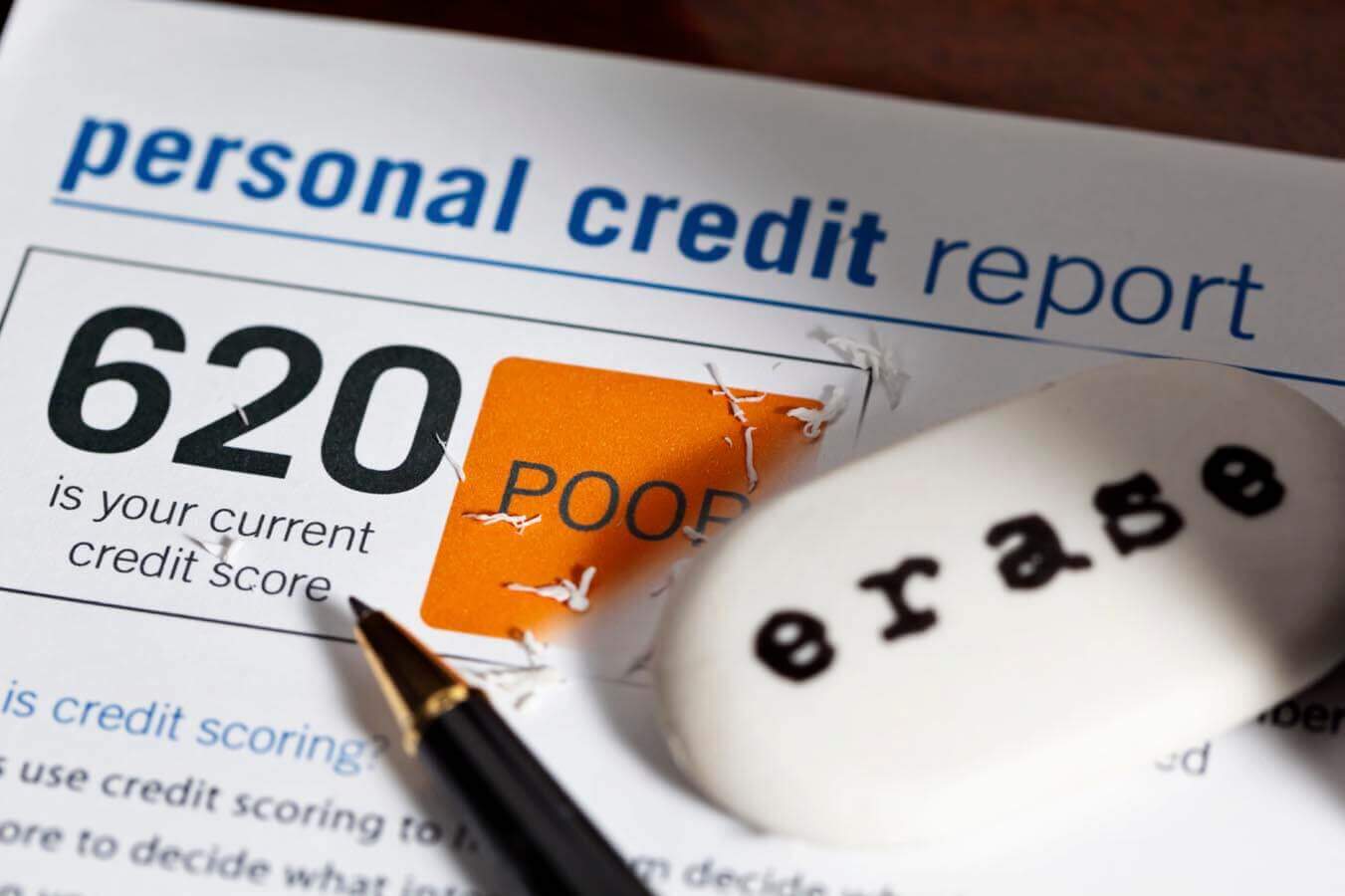

Comprehending credit rating is necessary for anybody seeking to enhance their financial wellness and gain access to better loaning options. A credit rating is a numerical depiction of an individual's credit reliability, usually ranging from 300 to 850. This score is created based on the details included in an individual's credit score report, that includes their credit report, superior financial obligations, settlement history, and sorts of credit score accounts.

Lenders utilize credit history ratings to evaluate the risk connected with lending cash or extending credit report. Higher scores show reduced danger, usually resulting in extra beneficial car loan terms, such as reduced rate of interest and greater credit line. On the other hand, lower credit rating can lead to higher rate of interest prices or rejection of credit history completely.

Several variables influence credit report, including payment history, which accounts for around 35% of the rating, followed by credit history application (30%), length of credit report (15%), kinds of credit history in operation (10%), and brand-new credit score questions (10%) Recognizing these factors can empower individuals to take actionable actions to boost their scores, eventually improving their monetary opportunities and security. Credit Repair.

Common Credit History Issues

Numerous individuals face typical debt concerns that can hinder their monetary progression and impact their credit rating. One common issue is late repayments, which can substantially damage credit report rankings. Even a single late repayment can continue to be on a debt report for numerous years, affecting future borrowing capacity.

Identification theft is one more major problem, possibly bring about deceptive accounts showing up on one's credit report. Such scenarios can be testing to fix and may call for substantial initiative to clear one's name. Additionally, inaccuracies in credit scores reports, whether due to clerical mistakes or out-of-date info, can misstate an individual's credit reliability. Resolving these typical debt issues is important to enhancing monetary wellness and establishing a strong credit report profile.

The Credit Rating Repair Refine

Although credit score repair service can seem complicated, it is Continued an organized process that people can embark on to enhance their credit report scores and rectify inaccuracies browse around this site on their credit report records. The initial step entails getting a copy of your debt report from the three significant credit scores bureaus: Experian, TransUnion, and Equifax. Review these reports meticulously for disparities or errors, such as inaccurate account information or outdated information.

As soon as mistakes are recognized, the following action is to challenge these errors. This can be done by contacting the credit report bureaus directly, giving documents that supports your insurance claim. The bureaus are needed to check out disputes within thirty days.

Keeping a consistent settlement history and taking care of credit rating use is additionally crucial during this procedure. Checking your credit routinely ensures recurring precision and assists track renovations over time, strengthening the efficiency of your credit score repair work efforts. Credit Repair.

Benefits of Credit Report Repair Service

The benefits of credit score repair service prolong far beyond simply improving one's credit score; they can substantially affect financial security and chances. By resolving mistakes and adverse items on a credit scores report, individuals can boost their creditworthiness, making them a lot more eye-catching to lenders and banks. This enhancement typically causes much better rates of interest on finances, lower costs for insurance, and raised chances of authorization for bank card and mortgages.

Additionally, credit scores fixing can facilitate accessibility to essential services that need a credit history check, such as renting a home or acquiring an energy solution. have a peek at this website With a healthier credit report account, individuals might experience raised self-confidence in their economic choices, enabling them to make larger acquisitions or financial investments that were formerly unreachable.

Along with substantial financial advantages, debt repair service promotes a sense of empowerment. People take control of their monetary future by actively managing their debt, leading to more informed choices and higher financial literacy. In general, the advantages of credit report repair service add to a much more steady monetary landscape, eventually promoting long-lasting economic growth and individual success.

Picking a Credit History Repair Service Solution

Choosing a credit report repair work service requires careful factor to consider to make sure that people get the support they need to improve their financial standing. Begin by investigating prospective business, focusing on those with positive client evaluations and a proven track document of success. Openness is vital; a credible solution must clearly describe their timelines, processes, and fees ahead of time.

Next, verify that the credit score repair work service complies with the Credit Fixing Organizations Act (CROA) This federal regulation shields consumers from deceptive methods and sets guidelines for credit rating fixing services. Avoid business that make impractical assurances, such as guaranteeing a details rating increase or asserting they can remove all adverse products from your record.

Furthermore, consider the degree of consumer support supplied. A good credit repair work service must provide individualized assistance, permitting you to ask questions and receive timely updates on your progression. Try to find solutions that supply a detailed evaluation of your credit history record and create a customized technique tailored to your certain scenario.

Inevitably, choosing the best credit score fixing service can result in considerable renovations in your credit history, empowering you to take control of your monetary future.

Final Thought

To conclude, efficient debt repair strategies can considerably improve credit report by addressing common problems such as late settlements and errors. A comprehensive understanding of credit score aspects, incorporated with the involvement of reputable credit scores repair work services, facilitates the arrangement of adverse things and recurring progression tracking. Eventually, the effective enhancement of credit history not only causes better car loan terms however additionally cultivates greater financial chances and security, emphasizing the value of aggressive credit scores administration.

By dealing with problems such as settlement history and credit score use, individuals can take positive actions towards boosting their credit report scores.Lenders make use of credit rating scores to evaluate the danger associated with offering cash or expanding credit.An additional regular problem is high credit scores usage, specified as the ratio of current credit scores card equilibriums to complete offered credit scores.Although credit repair service can seem daunting, it is an organized process that people can carry out to boost their credit history scores and remedy errors on their credit score reports.Following, verify that the debt repair service complies with the Credit rating Repair Service Organizations Act (CROA)